Beware the Yield Curve

The yield curve should be keeping a lot of people up at night, making them nervous, and not for the reasons you might think. The inflation war cries are crushing, yet we are still not really seeing any concrete data points that are actually pointing to substantive inflation, let alone robust inflation.

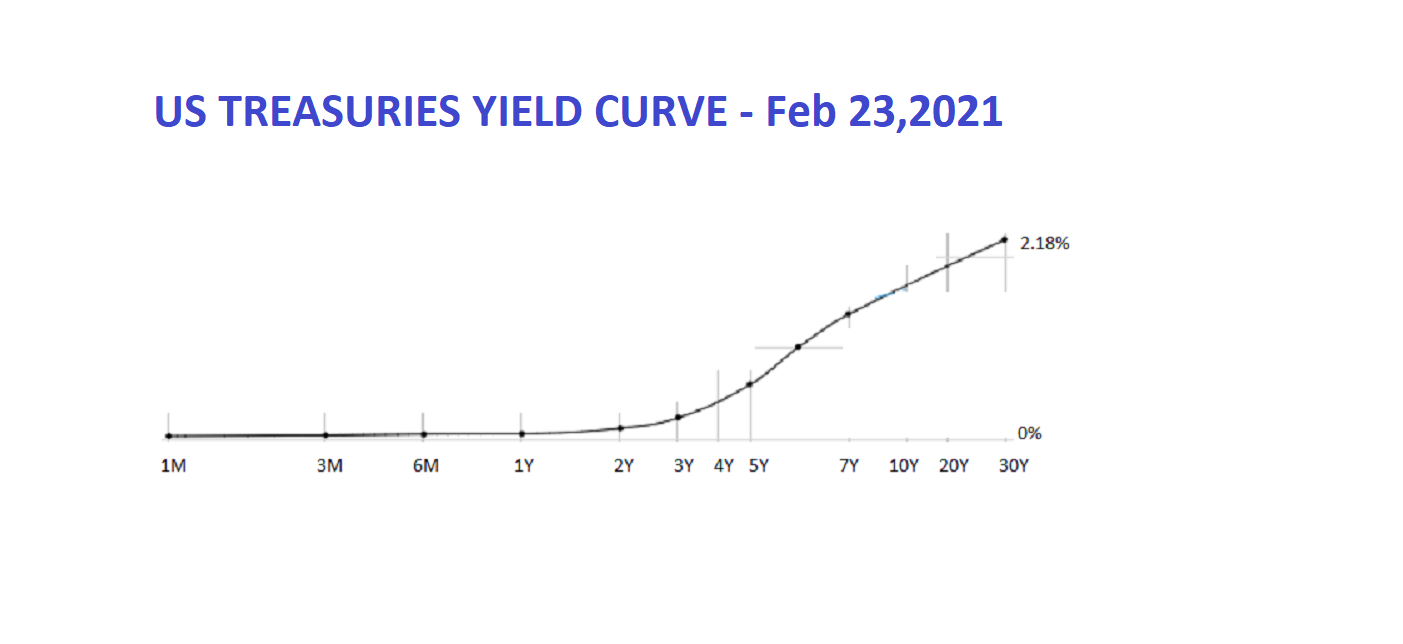

What should alarm traders is the speed at which the long end of the yield curve has risen – up and sharp – and far too quickly. Inflation, post a deflationary period, is usually a slow burning, gathering momentum cycle, not a rise from the bottom suddenly. Begs the question; so why is the sell-off of long dated US Treasuries accelerating so sharply ?

What’s happening on the long end of the yield curve is also known as a ‘bear steepener’ (as yields rise, bonds sell off which is bond-bearish). Some investors may really believe the inflation scaremongers, some may be following the herd, some of the sell-off may be because of rampant speculation in risk-on trades, and some may be quietly selling-off to provide liquidity to cover other positions.

The Fed is another wild card – while their stated position is to leave rates low and allow (if there is any) inflation to overstep temporarily, they know that rising long term yields is a major threat to equities, mortgage rates and corporate debt. Increased bond purchases may too be on the cards, stopping the bond blowout in it’s tracks.

Similarly, what should also be of real concern is the collapse of rates on the short end. The difference between the 2yr and 10yr yields is the highest since 2017. There is speculation that short term Treasury Bills may go negative in the secondary market, an occurrence that hasn’t happened since the March 2020 crash.

To me this spells trouble – it’s looking a lot like a liquidity crisis in the making. A perfect storm of under issuance of Treasury Bills combined with a flight to safety, may precipitate a shortage of Treasury Bills in the marketplace. If correct – this shortage could undermine collatoralization and hit the repo markets.

Rapid yield movemenst on both ends of the spectrum is a harbinger of re-positioning across asset classes.

Yield is a reward compensation for risk. With Treasuries as duration increases so does risk, hence the rush in times of stress to very short dated T-bills. Currently, the fastest growing assets classes are dividendless stocks like Tesla and Netflix as well as assets like Bitcoin – none of which offers any yield, only risk. High capital gain with no yield is speculation, not investment.

The markets are scrambling to reassess and realign risk vs yield – and we are seeing this battle wage between the short and long dates Treasury Yields.

The rise in yields is happening far too quickly and in a vacuum, absent data, for a normal robust market recovery. In fact, inflation numbers are tepid, employment numbers are abysmal and consumer confidence is erratic. These markets are driven by extreme ebullience and mania. Further sharp movements and corrections are possible in these volatile times.

Personally, I remain a strong proponent of long dated US Treasuries. The faster and higher that long dated yields go up, the quicker I believe they will crash back down to reality – but this is rife with risk and speculation. Whatever your portfolio, I would be extremely cautious now as we may be in for a very bumpy ride.

How to ensure your investments beat inflation

How to ensure your investments beat inflation

If you believe that inflation is really going to take off (we don’t), what should you do? Once again...

Searching for Real Yield

Searching for Real Yield

Following the kind of stock market blow-out that we are anticipating there will be plenty of high yi...

Beating the Drums of Inflation

Beating the Drums of Inflation

It seems like the inflationistas are predicting inflation rather than showing data to support it’s e...