How to ensure your investments beat inflation

How to ensure your investments beat inflation

If you believe that inflation is really going to take off (we don’t), what should you do? Once again...

Searching for Real Yield

Searching for Real Yield

Following the kind of stock market blow-out that we are anticipating there will be plenty of high yi...

Beating the Drums of Inflation

Beating the Drums of Inflation

It seems like the inflationistas are predicting inflation rather than showing data to support it’s e...

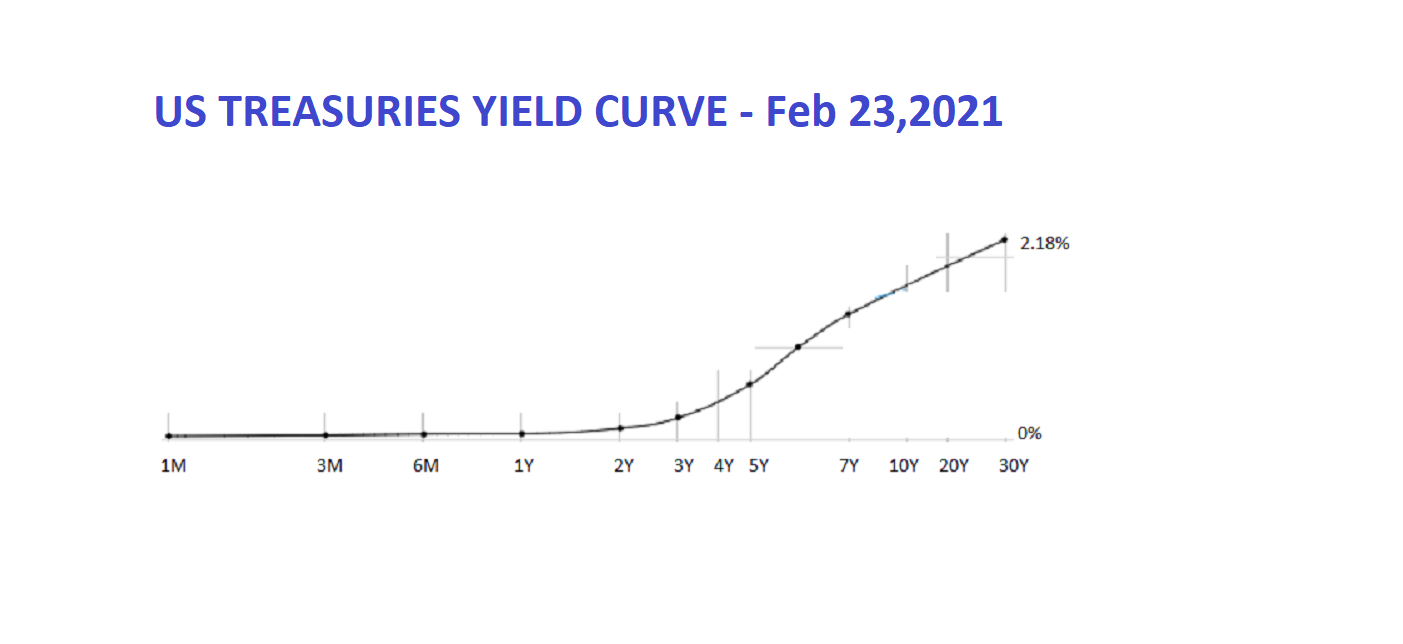

Beware the Yield Curve

Beware the Yield Curve

The rise in yields is happening far too quickly and in a vacuum, absent data, for a normal robust ma...

Lunatics have taken over the Asylum

Lunatics have taken over the Asylum

Bitcoin could conceivably go to 0. Stocks could potentially lose 80%. Never in our life time do we a...

Back to Normal: We're not buying it

Back to Normal: We're not buying it

Mainstream consensus is a return to normal - we're not buying it. Inflation, jobs, asset prices are...

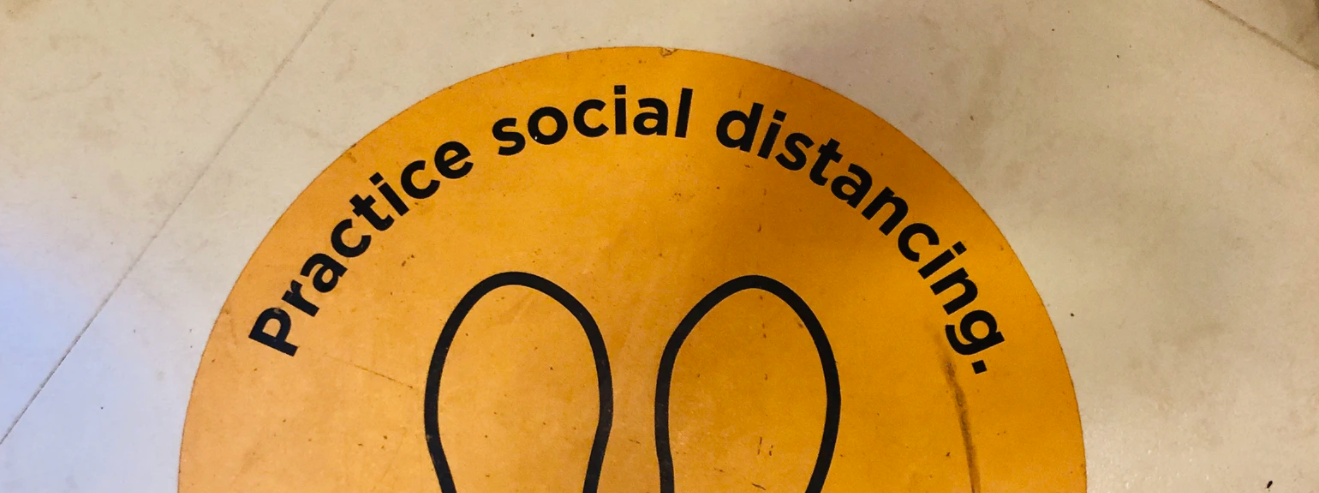

Vaccine: Shot of Reality

Vaccine: Shot of Reality

Assuming the vaccine is as protective as best case scenario, there remain more hurdles; never befor...

Markets Wait for an 'Aha' Moment: Pressure

Markets Wait for an 'Aha' Moment: Pressure

In more ‘usual’ times – the markets hate uncertainty and are skittish with bad news, especially that...

Treasuries Blow Out: We don’t agree

Treasuries Blow Out: We don’t agree

Yields on long dated Treasuries have climbed over the last few sessions. The markets are nervous all...

Debt is like NYC Tap Water: Cheap and Plentiful

Debt is like NYC Tap Water: Cheap and Plentiful

Nothing in New York is cheap, probably with the exception of tap water. Debt – and more specificall...

Stimulus isn't a Long Term Strategy: More like a Bet with a British Bookie

Stimulus isn't a Long Term Strategy: More like a Bet with a British Bookie

There’s an old adage: Markets hate uncertainty. But it seems that the current stimulus uncertainty...

Why Dollar Collapse may not be coming

Why Dollar Collapse may not be coming

It is difficult to think of any area in finance where more nonsense is written about than that of th...

State of the Economy: A House of Cards

State of the Economy: A House of Cards

Economic activity is a fraction of recent historical norms. The status quo is not sustainable. We ar...

The (almost) $10 Trillion Question ?

The (almost) $10 Trillion Question ?

The Fed knows that the economy is so over-leveraged, unproductive and bloated with trillions of doll...

The Black Swan that Breaks the Camel’s Back

The Black Swan that Breaks the Camel’s Back

We at MacroTOMI believe that the enormity of the current situation is so gigantic, that the current...

Why the Treasury Auction Wasn’t So Ugly

Why the Treasury Auction Wasn’t So Ugly

The spike in yields wasn’t because of better than expected jobs numbers or a jump in CPI or a jump i...

Employment Data Show Probable Dead Cat Bounce

Employment Data Show Probable Dead Cat Bounce

We are currently tempering unemployment with what is now the tail end of the Payroll Protection Prog...

Don't underestimate the Fed's playbook.

Don't underestimate the Fed's playbook.

By giving the allusion of a backstop, the Fed has enabled corporates to gorge on new debt issuance i...

The Markets are in a Suspended Animation Perpetuating a Denial of Reality

The Markets are in a Suspended Animation Perpetuating a Denial of Reality

Question is, why are we still here? Why is the market still exuberant? The market is waiting for mor...