If you believe that inflation is really going to take off (we don’t), what should you do? Once again the securities industry will mislead you and again suggest you buy gold, silver, platinum, rhodium, cryptocurrency and anything which will give them good commissions. There is one certain way to keep up and earn slightly more than the rate of inflation. Treasury Inflation-Protected Securities, or TIPS, provide protection against inflation

Searching for Real Yield

Searching for Real Yield

Following the kind of stock market blow-out that we are anticipating there will be plenty of high yi...

Beating the Drums of Inflation

Beating the Drums of Inflation

It seems like the inflationistas are predicting inflation rather than showing data to support it’s e...

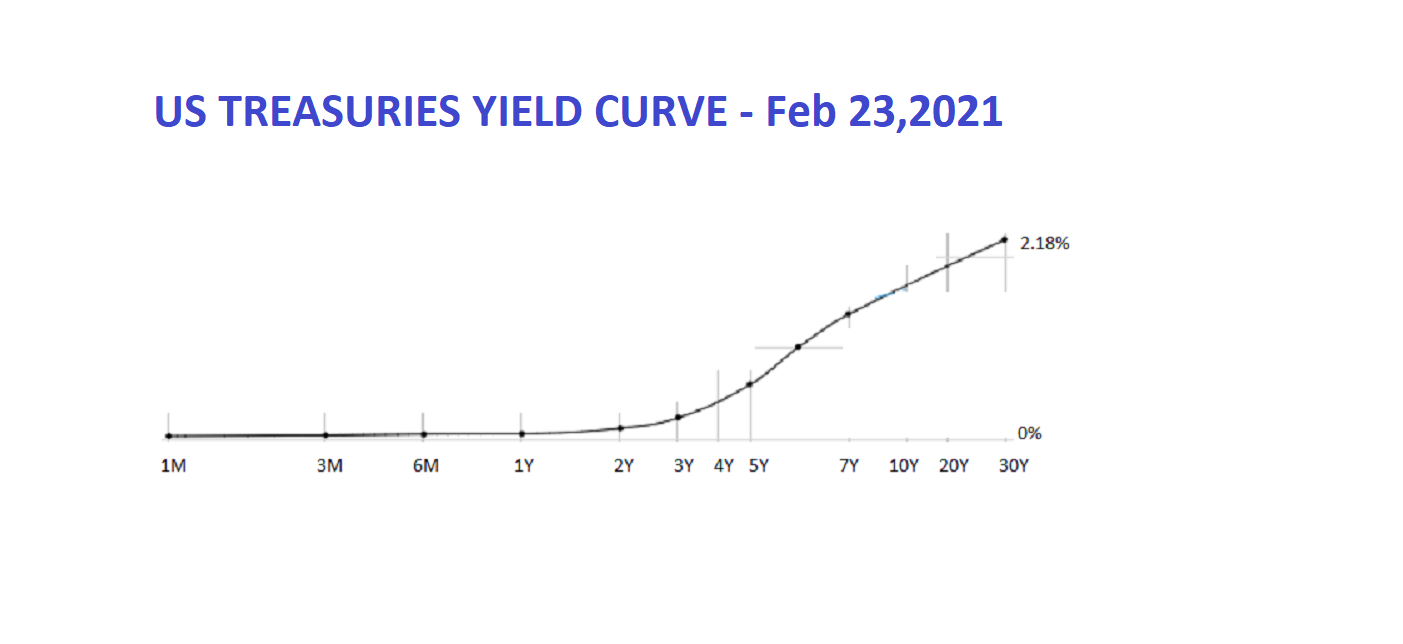

Beware the Yield Curve

Beware the Yield Curve

The rise in yields is happening far too quickly and in a vacuum, absent data, for a normal robust ma...

Lunatics have taken over the Asylum

Lunatics have taken over the Asylum

Bitcoin could conceivably go to 0. Stocks could potentially lose 80%. Never in our life time do we a...

Back to Normal: We're not buying it

Back to Normal: We're not buying it

Mainstream consensus is a return to normal - we're not buying it. Inflation, jobs, asset prices are...

China's Debt Problem; Keeping an Eye on it

China's Debt Problem; Keeping an Eye on it

China is the world’s second largest economy and often not seen anymore as an emerging market. China...

Financial Storm's Last Port: Sovereign Bonds

Financial Storm's Last Port: Sovereign Bonds

In a true and complete financial panic where everything is suspect liquidity will become paramount....

Vaccine: Shot of Reality

Vaccine: Shot of Reality

Assuming the vaccine is as protective as best case scenario, there remain more hurdles; never befor...

The psychological profile of a successful investor

The psychological profile of a successful investor

The interesting thing about investing is that individuals with a totally different outlook on the ma...

Markets Wait for an 'Aha' Moment: Pressure

Markets Wait for an 'Aha' Moment: Pressure

In more ‘usual’ times – the markets hate uncertainty and are skittish with bad news, especially that...

Finding a one-way bet: Rare but do exist

Finding a one-way bet: Rare but do exist

Rarely does an investor find a one-way bet or a 'golden opportunity', but they do exist. Here's a pe...

Treasuries Blow Out: We don’t agree

Treasuries Blow Out: We don’t agree

Yields on long dated Treasuries have climbed over the last few sessions. The markets are nervous all...

Debt is like NYC Tap Water: Cheap and Plentiful

Debt is like NYC Tap Water: Cheap and Plentiful

Nothing in New York is cheap, probably with the exception of tap water. Debt – and more specificall...

Stimulus isn't a Long Term Strategy: More like a Bet with a British Bookie

Stimulus isn't a Long Term Strategy: More like a Bet with a British Bookie

There’s an old adage: Markets hate uncertainty. But it seems that the current stimulus uncertainty...

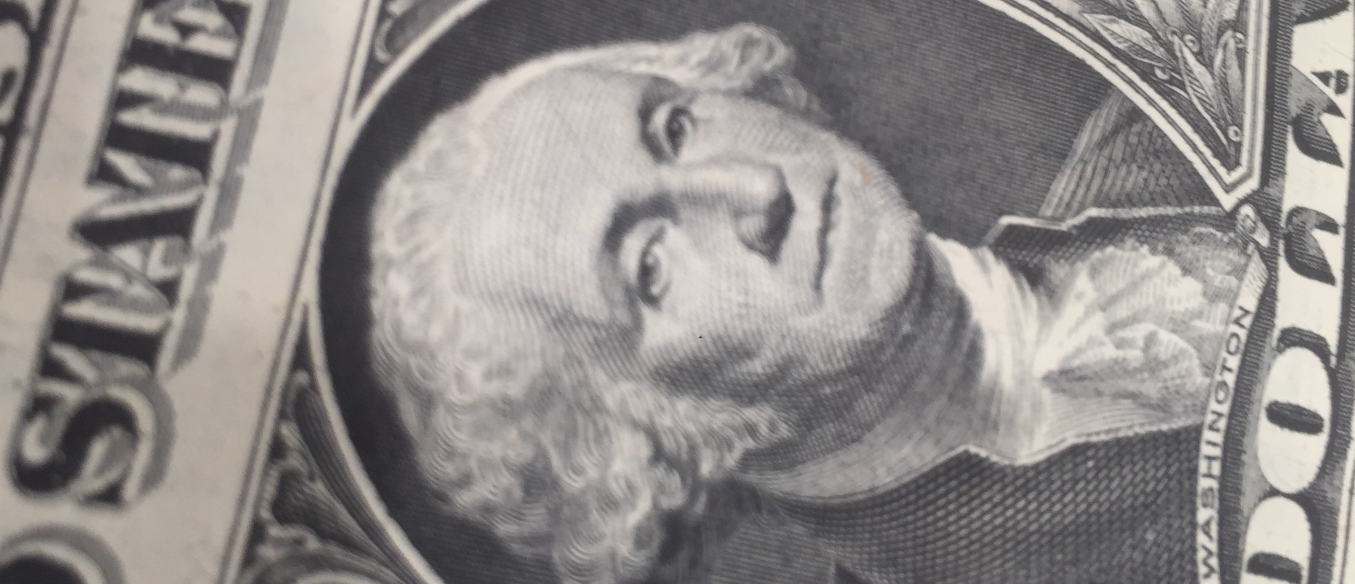

Why Dollar Collapse may not be coming

Why Dollar Collapse may not be coming

It is difficult to think of any area in finance where more nonsense is written about than that of th...

Storm's A Brewing: The dark clouds are starting to gather

Storm's A Brewing: The dark clouds are starting to gather

Sentiment is turning and the easiness of summer is fading. If we don’t get more stimulus there i...

State of the Economy: A House of Cards

State of the Economy: A House of Cards

Economic activity is a fraction of recent historical norms. The status quo is not sustainable. We ar...

Options: Are They an Option and How Do They Actually Work ?

Options: Are They an Option and How Do They Actually Work ?

Options are a hot topic - Softbank reported to be the 'Nasdaq Whale' booking $4B worth of profits on...

Talking About Inflation and Creating Inflation, Are Very Different Beasts

Talking About Inflation and Creating Inflation, Are Very Different Beasts

After decades of trying to create inflation, we have had lackluster results (and most of these years...

Short Selling is Fraught with Risk: The Mechanics

Short Selling is Fraught with Risk: The Mechanics

Short selling can be extremely profitable but it is fraught with risk and has become a professional...

The Real Value of Gold

The Real Value of Gold

Humans have always been fascinated by gold which is one of the heaviest natural elements. It invokes...

The (almost) $10 Trillion Question ?

The (almost) $10 Trillion Question ?

The Fed knows that the economy is so over-leveraged, unproductive and bloated with trillions of doll...

The Black Swan that Breaks the Camel’s Back

The Black Swan that Breaks the Camel’s Back

We at MacroTOMI believe that the enormity of the current situation is so gigantic, that the current...

Why the Treasury Auction Wasn’t So Ugly

Why the Treasury Auction Wasn’t So Ugly

The spike in yields wasn’t because of better than expected jobs numbers or a jump in CPI or a jump i...

Against the Gods: The Remarkable Story of Risk

Against the Gods: The Remarkable Story of Risk

Would you go skydiving if your parachute had a 50% chance of opening; most people would say no. T...

Where are the ‘Negative Real Rates’ ?

Where are the ‘Negative Real Rates’ ?

Such predictions of inflation are in its early days. Even if inflation does present itself – it woul...

Beggar Thy Neighbor: Death of Globalization and a New Protectionist Era

Beggar Thy Neighbor: Death of Globalization and a New Protectionist Era

‘Beggar thy neighbor’ is a term for making economic policies which will benefit your country at the...

No Inflation, No Stagflation, Yields and Bonds

No Inflation, No Stagflation, Yields and Bonds

Even with the explosion of the monetary base in 2008 with the great recession and the stimulus provi...

The Mechanics of Bonds

The Mechanics of Bonds

Originally all bonds were bearer, payable to whoever held them, like the notes in your wallet. Beare...

Why we think Treasury Bonds are still a Good Buy

Why we think Treasury Bonds are still a Good Buy

“You mean all I have to do is listen and I will become rich”. “Yes”, he replied, but most of you wil...

The Unravelling of The Emerging Market

The Unravelling of The Emerging Market

As the hunger for debt issuance had been growing at an insatiable clip, and the Latin American debt...

Historical Precedents are Important Lessons for Investing

Historical Precedents are Important Lessons for Investing

If you are investing on momentum alone you will not likely be successful in the long run. When it co...

Employment Data Show Probable Dead Cat Bounce

Employment Data Show Probable Dead Cat Bounce

We are currently tempering unemployment with what is now the tail end of the Payroll Protection Prog...

Is the Nasdaq blowing higher than the fundamentals?

Is the Nasdaq blowing higher than the fundamentals?

The Nasdaq these days is flirting with new record highs. This is pretty amazing and even more so if...

How to Invest: The prediction game and the money making game are in fact two different things

How to Invest: The prediction game and the money making game are in fact two different things

It is possible to get rich slowly but surely if you start when you are young. Getting rich quickly i...

Recovery is Looking Like a 'Z'-shape Recovery, Here's Why

Recovery is Looking Like a 'Z'-shape Recovery, Here's Why

Our recovery is going to take on more of a ‘Z’ shape. Since the virus broke, we have been plodding a...

Don't underestimate the Fed's playbook.

Don't underestimate the Fed's playbook.

By giving the allusion of a backstop, the Fed has enabled corporates to gorge on new debt issuance i...

The Unusual Situation of Negative Rates May Be Not So Unusual Soon

The Unusual Situation of Negative Rates May Be Not So Unusual Soon

Commercial banks would have an incentive during severe recessions and depressions to make negative i...

The Markets are in a Suspended Animation Perpetuating a Denial of Reality

The Markets are in a Suspended Animation Perpetuating a Denial of Reality

Question is, why are we still here? Why is the market still exuberant? The market is waiting for mor...