Beware the Yield Curve

Beware the Yield Curve

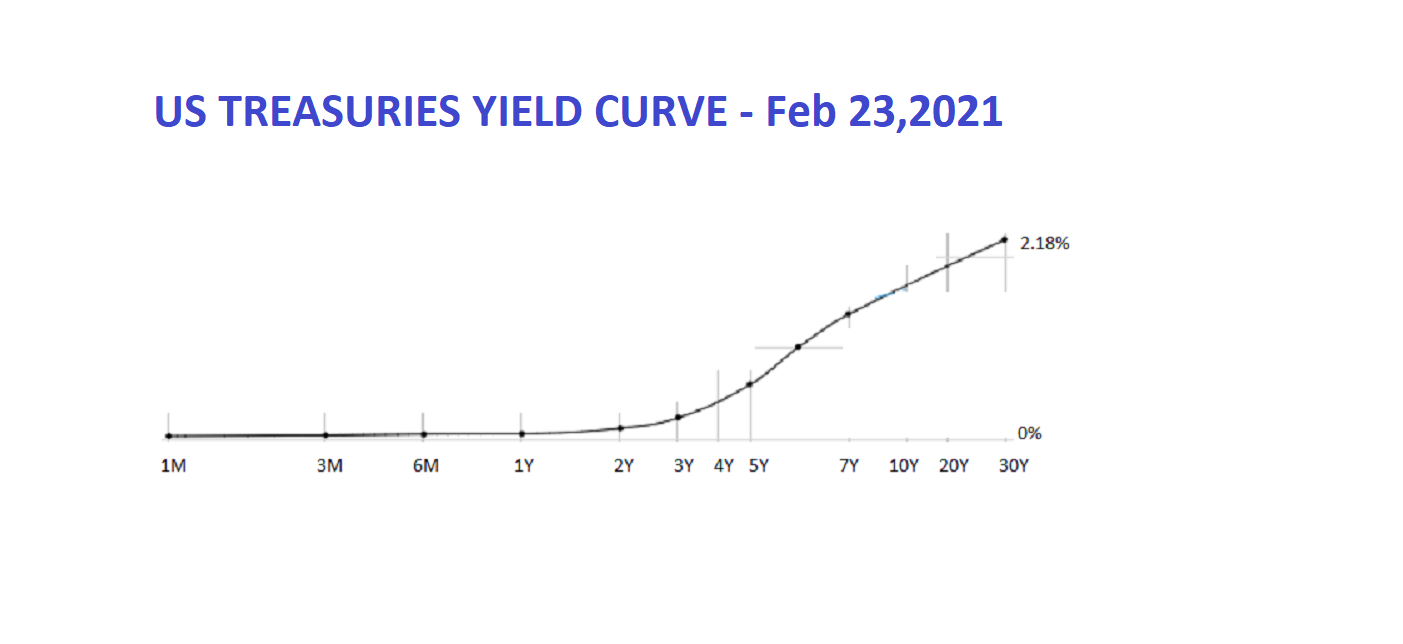

The rise in yields is happening far too quickly and in a vacuum, absent data, for a normal robust ma...

Lunatics have taken over the Asylum

Lunatics have taken over the Asylum

Bitcoin could conceivably go to 0. Stocks could potentially lose 80%. Never in our life time do we a...

China's Debt Problem; Keeping an Eye on it

China's Debt Problem; Keeping an Eye on it

China is the world’s second largest economy and often not seen anymore as an emerging market. China...

Financial Storm's Last Port: Sovereign Bonds

Financial Storm's Last Port: Sovereign Bonds

In a true and complete financial panic where everything is suspect liquidity will become paramount....

Treasuries Blow Out: We don’t agree

Treasuries Blow Out: We don’t agree

Yields on long dated Treasuries have climbed over the last few sessions. The markets are nervous all...

Debt is like NYC Tap Water: Cheap and Plentiful

Debt is like NYC Tap Water: Cheap and Plentiful

Nothing in New York is cheap, probably with the exception of tap water. Debt – and more specificall...

Stimulus isn't a Long Term Strategy: More like a Bet with a British Bookie

Stimulus isn't a Long Term Strategy: More like a Bet with a British Bookie

There’s an old adage: Markets hate uncertainty. But it seems that the current stimulus uncertainty...

The (almost) $10 Trillion Question ?

The (almost) $10 Trillion Question ?

The Fed knows that the economy is so over-leveraged, unproductive and bloated with trillions of doll...

The Black Swan that Breaks the Camel’s Back

The Black Swan that Breaks the Camel’s Back

We at MacroTOMI believe that the enormity of the current situation is so gigantic, that the current...

Why the Treasury Auction Wasn’t So Ugly

Why the Treasury Auction Wasn’t So Ugly

The spike in yields wasn’t because of better than expected jobs numbers or a jump in CPI or a jump i...

Against the Gods: The Remarkable Story of Risk

Against the Gods: The Remarkable Story of Risk

Would you go skydiving if your parachute had a 50% chance of opening; most people would say no. T...

No Inflation, No Stagflation, Yields and Bonds

No Inflation, No Stagflation, Yields and Bonds

Even with the explosion of the monetary base in 2008 with the great recession and the stimulus provi...

The Mechanics of Bonds

The Mechanics of Bonds

Originally all bonds were bearer, payable to whoever held them, like the notes in your wallet. Beare...

Why we think Treasury Bonds are still a Good Buy

Why we think Treasury Bonds are still a Good Buy

“You mean all I have to do is listen and I will become rich”. “Yes”, he replied, but most of you wil...

The Unusual Situation of Negative Rates May Be Not So Unusual Soon

The Unusual Situation of Negative Rates May Be Not So Unusual Soon

Commercial banks would have an incentive during severe recessions and depressions to make negative i...

The Markets are in a Suspended Animation Perpetuating a Denial of Reality

The Markets are in a Suspended Animation Perpetuating a Denial of Reality

Question is, why are we still here? Why is the market still exuberant? The market is waiting for mor...