Against the Gods: The Remarkable Story of Risk

In one of my previous articles I discussed the role of risk in investment. The above is the title of a book by Peter Bernstein. The book shows how people learned about risk and how to mitigate it and our attitude to risk. In the old days of course, taking risks like the Vikings did was challenging the ancient Gods, and traveling across oceans without really good navigational equipment. Would you go skydiving if your parachute had a 50% chance of opening; most people would say no. Would you fly middle seat in economy today to go on a vacation?

The inalienable law of investment is that the greater your possible rewards, the greater the risk. At the moment there is not a single investment category which is not filled with risk. You don’t really understand risk until you see your money evaporate. The commission hungry broker or website will never ever tell you this.

Here is a quick test to determine your attitude to risk. You like to visit casinos for fun. In one casino the roulette wheel has a standard green ‘zero’ slot, but the free drinks do not have the selection and quality of casino two which has mature bourbon and tequila and single malt Scottish whiskey but whose roulette wheels contain an extra ‘double zero’ green slot. In which casino would you play? If you would play in casino two then you are immediately putting yourself at a 1/38 disadvantage and ruining any strategy you may have had, which is why they give you the better drinks to sucker you in. It is better to play in casino one and win. You can then buy your own whiskey!

Currently we find that there are very few go areas for investment, i.e. where reward exceeds risk with the possible exception of long Treasury bonds but if you still want to metaphorically play in casino two that’s up to you. Most areas of investment are really ‘no go’ presently except for risk takers. So if you would still go sky diving with a 50% chance of the parachute opening there are a host of investments to buy, including, bitcoin, gold, silver and stocks and corporate bonds because you never know, you might have one of the parachutes that opens. We think skydiving is great when it’s done with a parachute that has a 99% chance of opening and a backup chute for when the first one fails to open, which of course is how sky-diving is usually done.

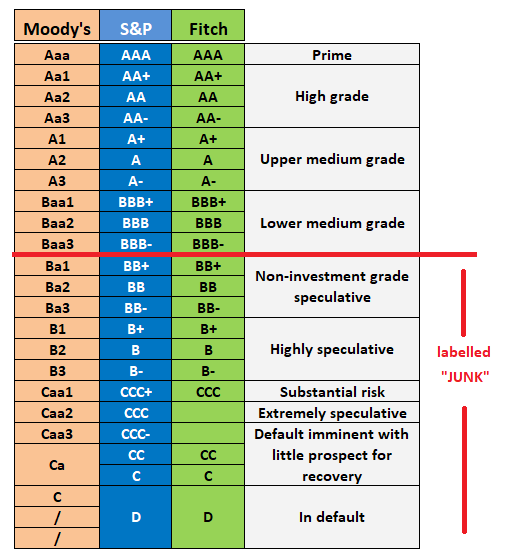

Bonds are rated by three main rating agencies, Moody’s, Standard and Poor’s and Fitch. They are rated as below:

The higher up you go the better the quality and the lower the risk of non-payment of interest and principle. The lower the rating of the bonds the higher the yield you should demand to offset your investment risk. This is called the ‘quality spread’.

Interestingly the bonds of the ‘hot’ stocks bear no relation to the credit rating of their outstanding bonds. For example, Apple bonds and Google bonds are AA+ and those of Tesla are BB-. This has prompted us to wonder if investors think the bond and the equity companies are somehow different entities. They are not. If Tesla could not make good on its bonds what do you think will happen to the stock? We again belabor the point that the key to all markets is ultimately the bond markets. And the bond markets are the area where risk is often, like now most obvious.

The ancients knew that when you went against the Gods they had a habit of taking their revenge which is why they offered up all kinds of sacrifices of animals and people and even children. Do you want to buy investments that go against the Gods, hoping that they will not take their revenge against you, or do you want to sacrifice a small possible profit in appeasement so that with time and patience you can take them on again.

How to ensure your investments beat inflation

How to ensure your investments beat inflation

If you believe that inflation is really going to take off (we don’t), what should you do? Once again...

Searching for Real Yield

Searching for Real Yield

Following the kind of stock market blow-out that we are anticipating there will be plenty of high yi...

Beating the Drums of Inflation

Beating the Drums of Inflation

It seems like the inflationistas are predicting inflation rather than showing data to support it’s e...

- How to ensure your investments beat inflation

- Searching for Real Yield

- Beating the Drums of Inflation