How to ensure your investments beat inflation

Currently it seems everyone is worried about financial inflation. We have discussed the concept for now but for simplicity we will regard it as the Consumer Price Index (CPI). In the seventies inflation surged to 25% in the United Kingdom and Japan and 12% in the United States and to around 6-8% in continental Western Europe including West Germany and Switzerland. All investors began looking for ‘inflation hedges’, from the conservative to the exotic.

Conservative investors converted funds into Deutschmarks and Swiss Francs and opened deposit accounts which usually incurred fees. Others bought gold and silver and platinum as an inflation hedge , but there was no guarantee of whether these would beat inflation or not. Others bought farmland, industrial property, or domestic property with the attendant illiquidity. Yet others bought diamonds of varying qualities or paintings and prints by lesser known artists. All forms of collectibles including chromium plated coca-cola bottles and commodities including canary seed. Nothing was too bizarre, especially if the purveyors could generate large commissions. Some of these did very well, others did not, so beating inflation was largely a speculative effort with all that entails.

Our favorite investment adviser, the late Robert Beckman, probably the last individual who made his fortune exclusively by trading his own account longed to find a conservative investment which could beat inflation. Then, in the early eighties just as inflation was abating first the UK and then a bit later the US treasury announced the issuance of inflation linked government bonds. The struggle for British and American investors was essentially over. Bob was overjoyed but at that stage he felt that yields on conventional bonds which were in double digits and likely to fall further represented a better investment.

Like many of today’s financial analysts, Bob had started his career in the financial industry and unlike those of today who are no longer in the industry he was not afraid to call the industry out on its poor treatment of individual investors. I am sure you have noticed that nothing has changed. Individual investors are like lambs and eventually get slaughtered. When you slaughter lambs you fatten them up first and I am sure you are aware the lambs are getting fat. You know what comes next.

This brings me to the point of this article. If you believe that inflation is really going to take off (we don’t), what should you do? Once again the securities industry will mislead you and again suggest you buy gold, silver, platinum, rhodium, cryptocurrency and anything which will give them good commissions. So you will be back in the seventies either buying speculative or illiquid investments, not really knowing where you are going to end up, either with huge profits or big losses – much like today’s speculative bets.

This is not the way to plan for your retirement or child’s college fund. There is one certain way to keep up and earn slightly more than the rate of inflation. Treasury Inflation-Protected Securities, or TIPS, provide protection against inflation. The principal of a TIPS security increases with inflation, and decreases with deflation, as measured by the Consumer Price Index (CPI). When a TIPS matures, you are paid the adjusted principal or original principal, whichever is greater.

TIPS are issued with varying maturities and coupons just like regular bonds. This means you can buy a bond projected to mature in 10, 20 or 30 years depending on when the funds will be needed. They are bought in units of $1000 and at maturity the pay-out is 1000 times the accumulated rate of inflation over the years. It is possible to check the accrued principal value daily. The interest payment every month is the stated coupon value multiplied by accumulated inflation rate as well so the interest payments are inflation protected as well.

Like all interest bearing securities they should preferably be held in a tax sheltered vehicle. They are tradeable and can be liquidated at any time should the funds be needed urgently. There may be deficiencies in the CPI as an inflation measure of course, but its objective and knowable and not a fantasy future value like those of so many other inflation hedges. While I think a carefully selected portfolio of regular bonds is preferable they require more attention and monitoring. While you may not make a lot of money buying TIPS, your retirement funds will be secure and you will not incur much in the way of brokerage charges and commissions and very few financial advisors will recommend them because they generate so little commission income.

Searching for Real Yield

Searching for Real Yield

Following the kind of stock market blow-out that we are anticipating there will be plenty of high yi...

Beating the Drums of Inflation

Beating the Drums of Inflation

It seems like the inflationistas are predicting inflation rather than showing data to support it’s e...

Beware the Yield Curve

Beware the Yield Curve

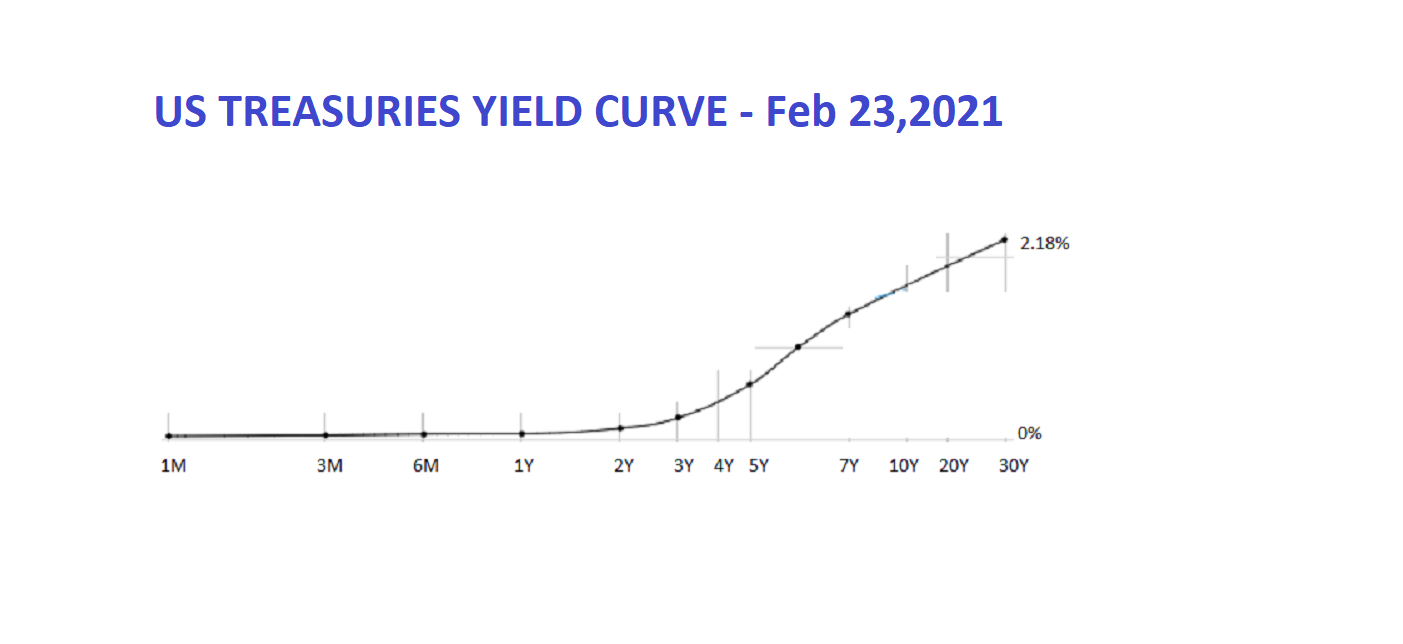

The rise in yields is happening far too quickly and in a vacuum, absent data, for a normal robust ma...