Searching for Real Yield

Here at Macrotomi we have discussed many aspects about bonds. The real investment benefit of bonds, in more usual times, is to take advantage of the 8th wonder of the world according to Bernard Baruch, compound interest. (read our article: why we think Treasury Bonds are still a good buy)

Currently any bond which gives a yield over 6% is very low quality and very high risk. To double your money by compounding you need to follow the rule of 72. Divide 72 by the interest rate - for example 6% - and you get 12. So it will take 12 years to double your money if you compound at 6%. You can see how great it was when interest rates were 14% but then most people still bought stocks or gold at the time. As we never tire of saying, “Investment is an emotional business where it should rather be a rational one”. This is why investment advisers sell you products which appeal to your emotions rather than your rationality, and which generate big commissions for them.

There is one exception at the moment. These are the bonds of Petroleos Mexicanos (Pemex), the Mexican oil company. Mexico is a Latin American country which is of course not in South or Central America but in fact in North America. I say this not to be pedantic but to reinforce the notions that despite some of the similarities it has with other Latin countries, its geographical location and economic relationships with Canada and the United States are a significant influence. Pemex is a wholly owned company of the Mexican government but it is not directly guaranteed by the Mexican government. It is in the same position as the Federal National Mortgage Association (‘Fannie Mae’), the Federal Home Loan Mortgage Corporation (‘Freddie Mac’) but not the Government National Mortgage Association (‘Ginnie Mae’), which was always a US governmental responsibility.

Before 2008, Fannie Mae and Freddie Mac were moral responsibilities and not direct responsibilities of the Federal government. The crisis of 2008 brought them under the government wing. I suspect that a crisis in Mexico would do the same for Pemex but there are no guarantees. Pemex bonds have a significantly higher yield than direct Mexican government obligations (up to 200 basis points) which is an unusually high spread. Before 2008, Fannie and Freddie usually had only a 60-80 basis premium over treasuries.

Currently Pemex has about $100 billion in bonds outstanding of various maturities. Yields are from 5-8% depending on the maturity of the bonds. These yields are significantly higher than those of the Brazilian oil company Petróleo Brasileiro S.A. (Petrobras) which is 60% owned by the Brazilian government.

Pemex bonds would of course sell off in any stock market crisis as they follow the path of corporate emerging market bonds. Under these circumstances yields could go up to 10-11%. Even at current levels they should be bought and placed in a tax sheltered plan like an IRA or 401k or in a Canadian RRSP and the interest used to buy further bonds to allow a compounding effect. If you are far from retirement a small position can be allowed to grow over the years so that you can get a true capital compounding effect.

Following the kind of stock market blow-out that we are anticipating there will be plenty of high yielding bonds available with a reasonable risk profile so that compounding your way slowly and deliberately to wealth will be easy for those who possess the virtue of patience and stoicism which very few people have today.

In the meanwhile you can start your get rich slowly but almost assuredly plan by adding some long dated Pemex bounds to your retirement account.

How to ensure your investments beat inflation

How to ensure your investments beat inflation

If you believe that inflation is really going to take off (we don’t), what should you do? Once again...

Beating the Drums of Inflation

Beating the Drums of Inflation

It seems like the inflationistas are predicting inflation rather than showing data to support it’s e...

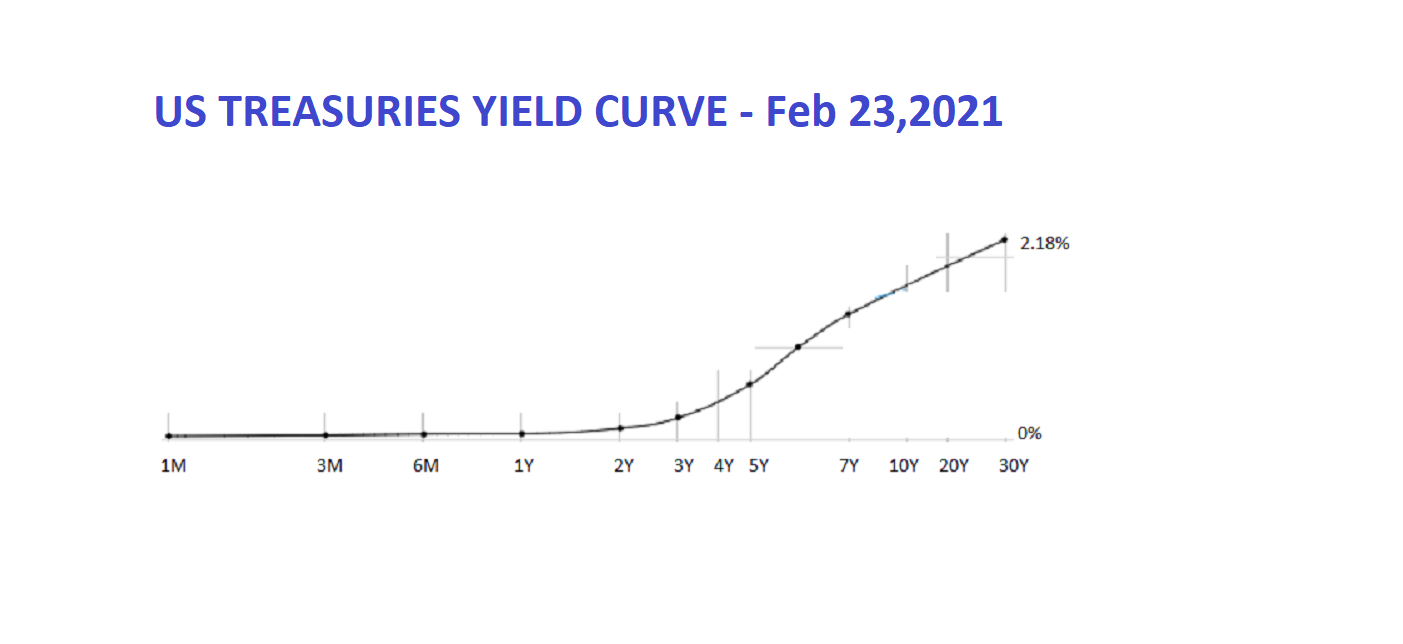

Beware the Yield Curve

Beware the Yield Curve

The rise in yields is happening far too quickly and in a vacuum, absent data, for a normal robust ma...