Beating the Drums of Inflation

The war cries of inflation, reflation, stagflation and hyperinflation are getting louder. The argument of impending inflation is a reasonable one; supply constraints (like chip shortages), $1.9T new fiscal stimulus, pent up demand and wide roll out of vaccination. Culminating in a frothy, frenzy of increased economic activity and foretelling of future robust corporate earnings.

But this analysis is one dimensional. Inflation is a passionate topic of ours that we have written extensively about. Here are a few of our previous articles for reference:

-Back to Normal: we’re not buying it

-Talking about Inflation and Creating Inflation are very different Beasts

-No Inflation, No Stagflation, Yields and Bonds

First, let’s examine the data. The CPI numbers are well within range and below the Fed’s stated goal of 2% inflation. January Core CPI was 0% - not exactly super inflationary, while the PPI Core was up 1.3% which shows a little bit of producer pressure, but it remains to be seen if these can be passed on to the consumer and if this is anything more than temporary supply chain issues (like shipping costs).

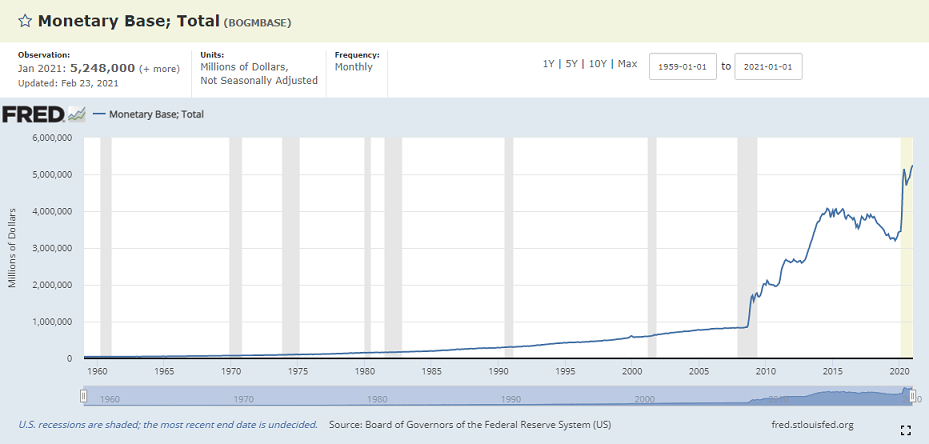

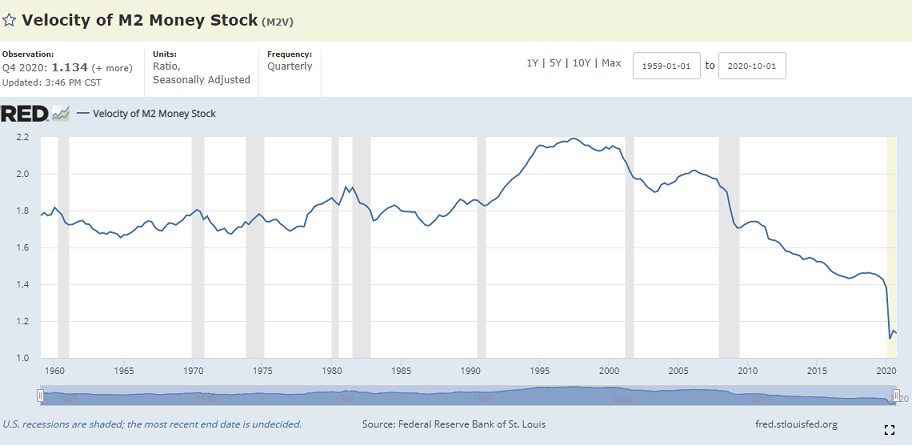

We’ve written before about monetary inflation vs (asset) price inflation (and we recommend you read: No Inflation, No Stagflation, Yields and Bonds). While M2 money supply has absolutely exploded, monetary velocity (M2V) is still substantially muted. Absent velocity, monetary inflation is improbable [MV = PQ ].

What about commodities ? Commodities are surging ahead amid calls of robust growth and supply side shortages. With $1.9T stimulus on the cusp, what we do know historically about big fiscal stimulus, is that it weakens the USD. This may be a compelling reason for commodity price spikes, coupled of course with speculation.

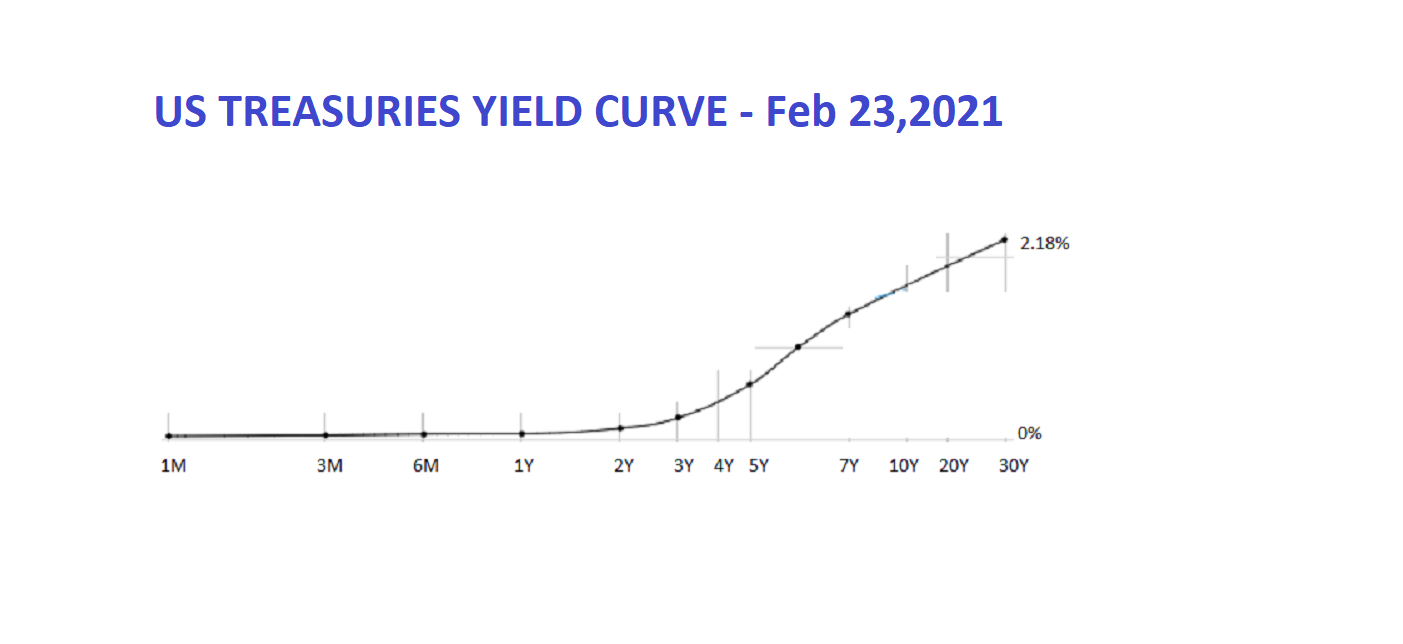

Yields are rising as the markets are anticipating inflation, is another argument. Treasury yields on the long end have moved up swiftly this past month – potentially too quickly. But here’s the interesting thing; bar yesterday’s market sell offs, over this same time frame, HY (high yield) Corporate Bonds – the junkiest of junk – saw no downward pressure on their bonds prices. Are we now in a world where inflationary pressures affect Treasury Bonds but not Corporate Bonds? Even if higher inflation meant record breaking corporate profits, bond yields are fixed and the return on investment would similarly be debased away by the same inflation affecting Treasuries. This is anomalous.

It seems like the inflationistas are predicting inflation rather than showing data to support it’s existence. We all know how the prediction game goes – you have at best 50-50 odds in your favor of being correct.

Let’s say the inflationistas are correct and we do see robust inflation take hold – for a sustained period. How will the broad based economy react. The past year’s reflation (and actually all of the growth since 2008 – if not longer) is entirely predicated on an explosion of debt. This debt is underpinned by low and falling yields and cost of borrowing.

As a result, we are swimming in zombie corporations that have issued debt at ridiculously low yields (record low spreads). So if rates were to move up substantially, what happens when these corporation need to issue more bonds to roll over existing debt or just to keep in existence? It won’t take much of a hike in yields to send the Corporate Bond market into severe distress.

Overshadowing the economy is unemployment of around 19M people. Many of these jobs are lost and there has been a structural shift in the economy, meaning many may not return. Wage pressures remain low for some time. Even at 3% unemployment pre-pandemic, wage growth was quite muted.

This means that consumer’s pay packets aren’t increasing – so in order to afford bigger ticket purchases, lower interest rates are needed to translates into lower monthly (i.e. affordable) monthly payments for mortgage rates, car loan rates, credit card rates, student debt, etc. Rising interest rates increases the cost to consumer with no ‘inflationary’ wage increases to offset – resulting in dampened demand. Absent wage growth, inflation should remain quite tepid.

As yields in the US rise, it makes returns on emerging markets less and less favorable. Were yields to continue rising, we could see the precipitation of an emerging market crisis and a rush out of those markets.

Lastly, huge amounts of Government stimulus come with the argument that rates are so low that the interest costs are minimal. As rates increase so do budgetary pressures and restraints. It will push bigger stimulus packages off the table.

While the simple call is about coming inflation and higher rates, the implications of that argument are not well thought out. Even if we get rate rises (which we doubt), they would be short term. The markets are so over leveraged and fragile, they won’t survive any meaningful spike in long term yields.

How to ensure your investments beat inflation

How to ensure your investments beat inflation

If you believe that inflation is really going to take off (we don’t), what should you do? Once again...

Searching for Real Yield

Searching for Real Yield

Following the kind of stock market blow-out that we are anticipating there will be plenty of high yi...

Beware the Yield Curve

Beware the Yield Curve

The rise in yields is happening far too quickly and in a vacuum, absent data, for a normal robust ma...