Markets Wait for an 'Aha' Moment: Pressure

The markets are very good these days at not reacting to any unsavory news. My colleague just wrote about his amazingly rare one-way bet (read: Finding a one-way bet: Rare but do Exist). The markets are not one of these one-way bets, contrary to what many, many, investors believe.

In more ‘usual’ times – the markets hate uncertainty and are skittish with bad news, especially that which begets more uncertainty. We are at the top of the uncertainty meter - yet, the markets are as calm as Lake Placid.

I wrote some time ago – June 30,2020 – about how the markets were in ‘suspended animation’ (read: The Markets are in a Suspended Animation Perpetuation a Denial of Reality) and I firmly believe that we have not exited that sense of denial. This denial is borne out by the rising number of Covid cases, worldwide.

It’s clear we are not getting a stimulus deal anytime in the immediate future – and this should be rattling markets – it’s an immense amount of uncertainty. But it’s not. Also interestingly, all of the asset classes supposedly affected by the promise of more stimulus – Gold, Treasuries, Equities – are not moving in the opposite direction sans stimulus. Good news is good, bad news is ignored.

So what does this tell us? There is now so much uncertainty around – Covid, elections, bi-partisan paralysis – that the fear hasbecome so great - it’s created inertia. Frozen from fear.

To me what is particularly interesting is the recent spike in Treasury Yields and the immense speculation taking short positions against the 30yr. Yet – there is no stimulus, no roaring inflation and no struggle to sell new debt into the market. Yields have already softened – consistent with our thinking (read: Treasuries Blow Out: We don’t Agree – Oct 22,2020).

We at MacroTOMI believe that something has to give and that the markets are setting themselves up for a big ‘Aha’ moment. Investors are sitting on the sidelines until after Nov 3 in a wait and see holding position. But the positive panacea that the markets are wishing for won’t come quickly – regardless of the election outcome.

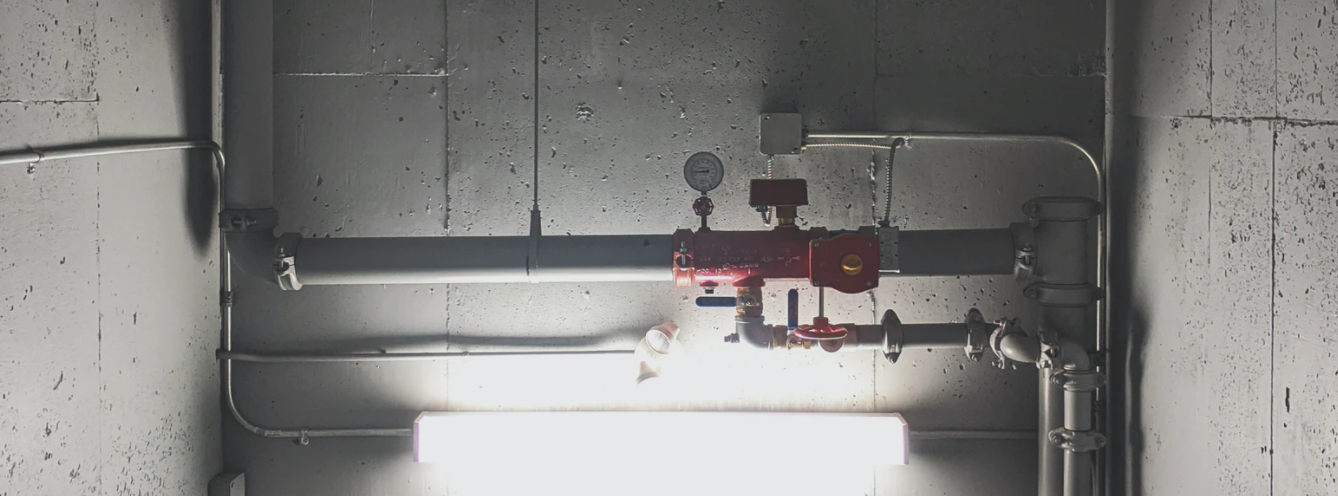

More and more pressure will eventually force the markets to move – such outlets often come swiftly and ‘unexpectedly’. Buckle up.

How to ensure your investments beat inflation

How to ensure your investments beat inflation

If you believe that inflation is really going to take off (we don’t), what should you do? Once again...

Searching for Real Yield

Searching for Real Yield

Following the kind of stock market blow-out that we are anticipating there will be plenty of high yi...

Beating the Drums of Inflation

Beating the Drums of Inflation

It seems like the inflationistas are predicting inflation rather than showing data to support it’s e...