No Inflation, No Stagflation, Yields and Bonds

Chatter is all about inflation and stagflation. Traders are talking about TIPS, gold and other inflation hedges. We at MacroTOMI think the predictions of imminent inflation and /or stagflation are erroneous.

First – let’s define inflation: inflation is a term bandied around glibly with various meanings and interpretations. There are 2 types of inflation I’d like to differentiate; Price inflation and Monetary inflation.

Price inflation is the rise in the price of an item or basket of items. If you bought an asset say 10 years ago, the current market price may have risen, that difference between the price then and the higher price now, is price inflation. Monetary inflation is a macroeconomic measurement to calculate the rise of an economy’s monetary base relative to its transmission (velocity or movement) of that monetary base. Monetary inflation usually drives overall price inflation, but you can have rising prices – for example a coffee shortage makes the cost of an espresso increase x%, without broad monetary inflation.

Since the peak inflation years of the 1970s and early 1980s, where CPI peaked in double digits, we have seen a steady decline in interest rates – to now record lows - and correspondingly, steady declines in the monetary inflation rate.

Even with the explosion of the monetary base in 2008 with the great recession and the stimulus provided, in this 12 year period we have struggled to get a CPI reading much over 2%, with a peak CPI reading in 2011 of 3%. CPI by the way, is a measurement of price inflation of an arbitrary collection of items, cherry picked by the Department of Labor to supposedly indicate overall inflation. Monetary inflation can be negative, with a positive CPI.

So where was the stimulus induced inflation? Why did it not materialize back then? In 2008 there were similar cries to today of money printing that would lead to high inflation – in fact – some rallied a call that it would lead to hyperinflation. Both proved to be completely untrue.

Monetary inflation is measured with the following formula:

MV = PT

where M (money supply) x V (velocity) is equal to P (price) x T (output or transactions).

Based on this formula, there is a very simple explanation for why we don’t have and won’t have inflation down the pike in the foreseeable future. The reason is simply the velocity of money, or actually the lack thereof. Velocity is how quickly money changes hands as it moves through the economy. While pundits are talking about the expanding monetary base, few are mentioning velocity.

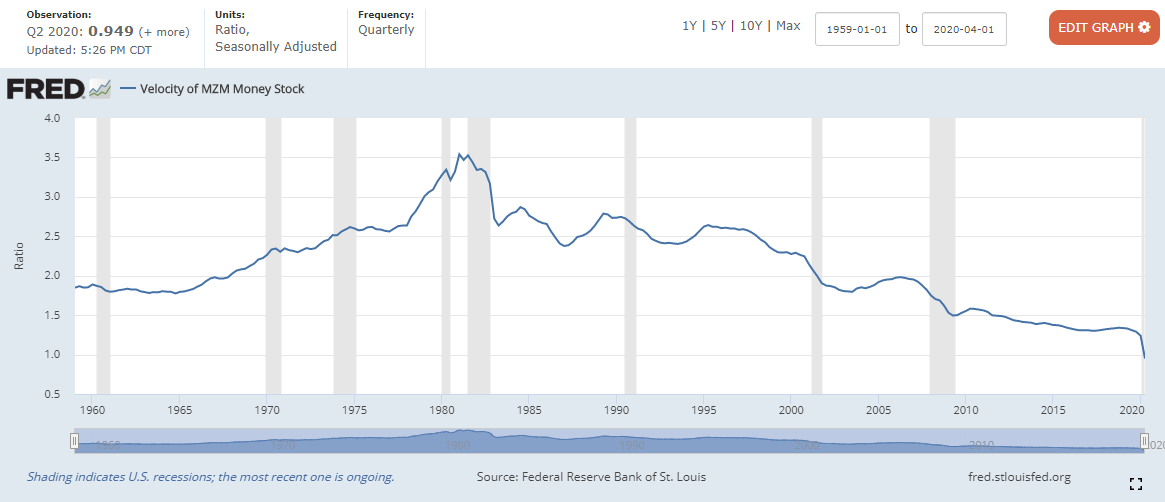

With the last round of stimulus, the huge monetary expansion went straight into various asset classes. We saw enormous spikes in the price of real estate, the stock market and expensive pieces of art. This is what fueled the objections that the rich had gotten richer and benefited disproportionately. Once an asset is purchased, those funds are generally parked in those asset classes. In fact, stimulus has created an inverse outcome – just like in Japan. Instead of companies spending money on expansion and productive growth, it is being funneled into share buyback schemes. This has resulted in an overall drop in labor productivity – in other words, our economy is becoming less productive. (Productivity change as per US Bureau of Labor – 2000-2007: 2.7% and 2007-2019: 1.4%). If you look at the graph below – Velocity of Money (MZM) : Source Federal Reserve Bank of St Louis, you can see that monetary velocity peaked in the early 1980s and has been on a decline every since.

What is even more convincing, is the slope of the graph in 2020 – it points to a sharp downward trend. This is absolutely consistent with the Q2 GDP reading of -33% and an economy locked down for months. With companies closed or half operating and people sitting at home, they have not spent the same amount of money as they would have. Monetrary velocity has crashed, ergo so has inflation irrespective of the monetary base expansion.

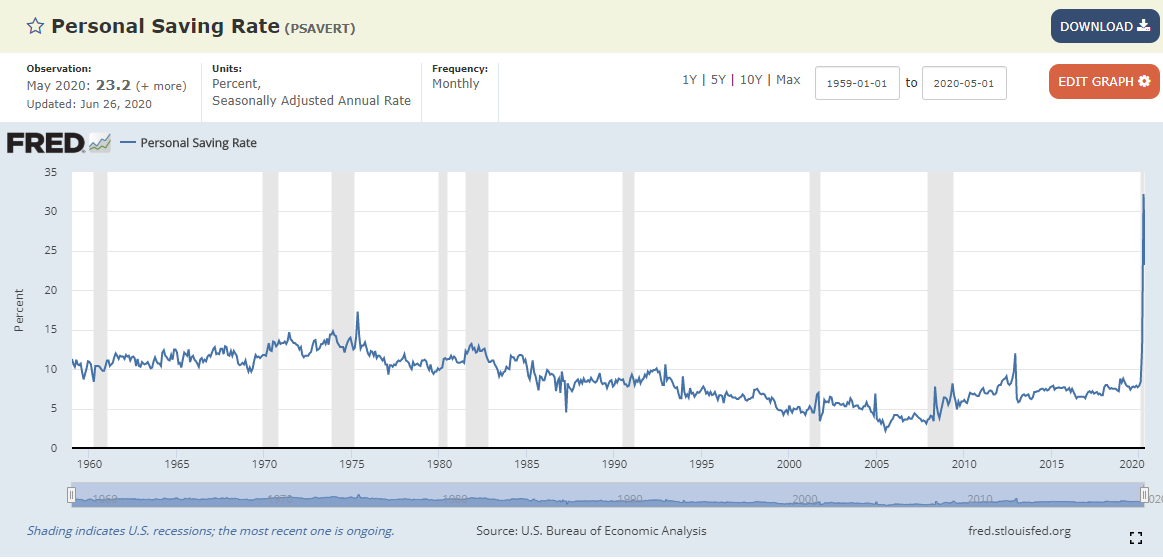

But, the question is what about stimulus and the $1200 checks? Let’s look at the personal savings rate – in other words what how much individuals have saved.

If you look at the graph below: Personal Savings Rate – Source: U.S. Bureau of Economic Analysis – the current trend is interesting.

The personal savings rate has spiked from a single digit average over the last few decades to an anomalous peak over 30%. These are obviously exceptional times and fear for the future has forced individual to stash away cash, but it also is probably a result of halted economic activity and people not going out to spend. The reason is immaterial – the spike represents cash parked in a bank and parked cash has a velocity of 0. While stimulus checks are a lifeline to many, there are also many recipients who just aren’t spending.

Notwithstanding the biggest stimulus effort in history, a combined $7T, the expanded monetary base has done nothing for monetary inflation. In fact, the Fed should be (and is) worried about deflation.

Another counter argument I’ve heard is that supply disruptions, realignment of the supply chain and more expensive cost bases as well as shutdowns – like meat packing plants and shortage of cargo flights – will contribute to a supply side shock, forcing prices higher in a contracting economy and create stagflation. This is simply not true in our current environment.

Supply side shocks can create price spikes and inflation and this happened with the 1973 Oil Crisis. But that was against the backdrop a different economic cycle. In early 1973, the U.S. had an economy growing at over 10% and expanding. Oil was a vital, strategic commodity that was absolutely necessary to drive the economy. The oil embargo created a gross material supply shock of the most indispensable kind.

Today, we are in an economy that has shutdown. Coronavirus hasn’t affected basic infrastructure or any critical components. As outlined above, people aren’t spending – which leads to a decrease in demand. If the disease caused greater illness to the point of incapacitation, then we could see supply side shocks and theoretically inflation. But with limited supply shocks – like meat products – price elastic consumers would either pay higher prices and/or reduce demand and move to other substitutes. None of these threatens the very functioning of the economy or welfare of its citizens.

What the latest round of stimulus has done, is created asset price inflation which so far this has manifested in the stock market and gold price appreciation. All speculative. The Fed can continue its QE and money creation programs. The Treasury can try and throw more money at companies and people – but companies don’t want to employ people they don’t need and individuals, as we’ve seen, either save their stimulus or buy overpriced assets (like a rush to day trading on the Robinhood app) – not creating monetary velocity. Given the over issuance of debt and stimulus, we don’t see inflation taking root in the economy for at least a medium period of time. While stocks may continue to rise in search of asset price appreciation, there may be a point at which the contracting economy deflates even this optimism. Similarly, while speculative money chases gold, it won’t be needed as a hedge for inflation and this trade may reverse in a deleverage.

With more money creation, and declining inflation turning to deflation, we see interest rates and yields continue their 40year pattern of decline. And as the economy deteriorates, this will exacerbate lower demand, with yields quite possibly turning negative over a good portion of the yield curve.(read our article on: "The Unusual Situation of Negative Rates May Be Not So Unusual Soon").

With falling yields, we see long dated treasuries attracting strong capital gains – and as a good deflationary and defensive investment strategy (read our article on "Why we think Treasury Bonds are still a Good Buy"). Over inflated asset classes, beware!

How to ensure your investments beat inflation

How to ensure your investments beat inflation

If you believe that inflation is really going to take off (we don’t), what should you do? Once again...

Searching for Real Yield

Searching for Real Yield

Following the kind of stock market blow-out that we are anticipating there will be plenty of high yi...

Beating the Drums of Inflation

Beating the Drums of Inflation

It seems like the inflationistas are predicting inflation rather than showing data to support it’s e...